Get In Touch With Us!

We understand that navigating the world of health insurance can be overwhelming and confusing. That's why we're here to help. Whether you're looking for Medicare coverage, health insurance, indemnity insurance, life insurance, or dental and vision insurance, we have the expertise and resources to guide you and help you find the best plan for your needs. We are here to provide help and support every step of the way, from selecting the right plan to enrolling. With help from Tammy Chase Insurance, you can rest assured that you're making informed decisions about your health insurance coverage.

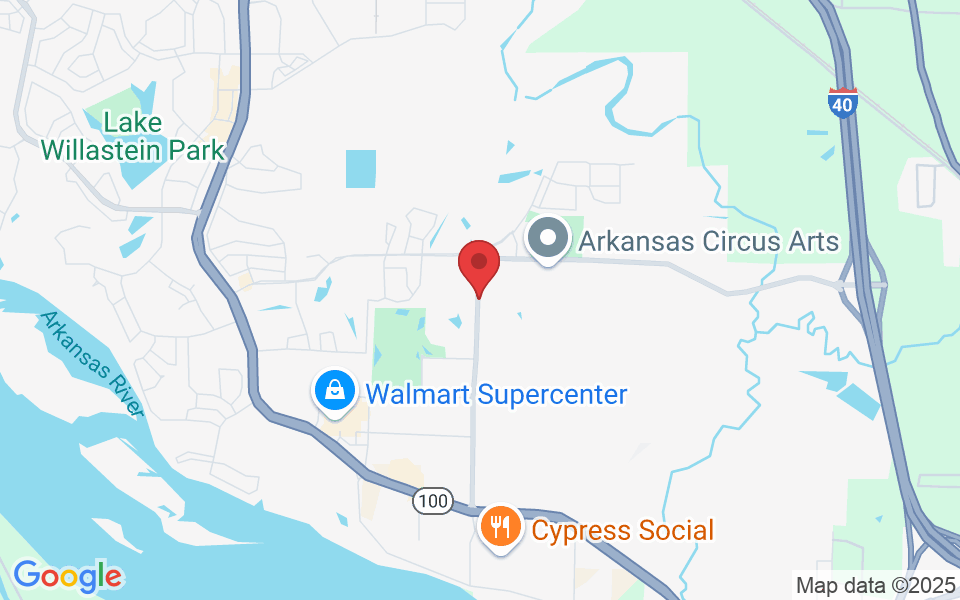

Call us at 501-463-9991 or Schedule an Appointment Below!

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.